Derrick Li

🌉 currently living in SF--------------------------------------------2023 - Present

🚀 investor at Afore2019 - 2022

🥳 building Macro with Peter Zakin2018 - 2019

🌎 traveling around the world, helping friends buy a bunch of industrial warehouses in Puerto Rico2014 - 2018

📈 hustling at Altimeter Capital - I was Brad Gerstner’s Analyst and Chief of Staff--------------------------------------------🚀 Angel investments✍️ Writing🤔 Following my curiosity

🚀🚀🚀🚀🚀

I like to be the first check in or amongst the first checks in after an entrepreneur decides to pursue an idea.* = first check--------------------------------------------Retool*

Pulley Studios*

Subframe*

Dreamlab*

Ollama

LangChain

Extend

TravelJoy

Nuvo

Collective Retreats

Rundoo

Adapt Insurance

Cover

Koya

Cosmic

Poggio

Thermal

ModelFront

Momentum

Junip

Neosync

Gridline

Sana

Properly

Bonsai Desk

TerrastructVenice*

RoomService

The Guild

Rume

Riff

Moonlight

Slight

Plan

Artifact

Flike

Milk Video*

QueenlyAcquired:

Hyper by Tradeshift

xCheck by FLYR

Cypher by Typeface

Atom Finance by Toggle AI

Wisely by $OLO

Reflect by SmartBear

CommandBar by $AMPL

Causal by Lucanet

Framework

"World-class fishermen // fisherwomen (team), fishing with the best tools (product & moats), in a sea full of fish (market)." - Rich Barton** **

--------------------------------------------

** **I mostly bet on people whom I admire & markets that I find to be under-appreciated.** **

--------------------------------------------

** **Characteristics of people I love working with:The Wizard of Oz philosophyHeart

Brains

Courage

Home** **

--------------------------------------------

** **Principles I (try to) follow:1. First principles

2. Inverse

3. Contrarian + being right

4. Removing emotions from investing

5. "The first rule is not to lose. The second rule is not to forget the first rule."

6. Find your "edge" - most things are already priced in** **

--------------------------------------------

** **Other things I enjoy doing🏃 hiking and running (3 marathons so far)🎾 playing tennis🎉 cooking & hosting dinner parties with friends🎨 drawing and painting📗 reading biographies and traveling // getting lost** **

--------------------------------------------

** **

Other things I enjoy doing

🏃 hiking and running (3 marathons so far)🎾 playing tennis🎉 cooking & hosting dinner parties with friends🎨 drawing and painting📗 reading biographies and traveling // getting lost

READING LIST

Articles:1. Can Risk be Reduced to a Number? (pg. 2 thru 4)

2. Michael Burry Letters

3. Perpetual Growth Machine

4. A Total Rethinking of Tencent's Strategy

5. Some Thinking Frameworks About Investment

6. Margin of Safety

7. Joel Greenblatt

8. Richard Rainwater

9. Spiritual Enlightenment by Jed McKenna

10. The War of Art

11. 36 Questions to Fall in Love** **

--------------------------------------------

** **Blogs:1. Clear Eyes Investing

2. Philosophical Economics

3. 25iq** **

--------------------------------------------

** **Books:1. Fooled by Randomness

2. A Short History of Financial Euphoria

3. Against the Gods

4. The Most Important Thing

5. The Intelligent Investor

6. One Up on Wall Street

7. Common Stocks and Uncommon Profits

8. The Little Book of Common Sense Investing

9. The Five Rules for Successful Investing

10. The Outsiders

11. The Little Book That Beats the Market

12. A Random Walk Down Wall Street

13. The Inner Game of Tennis

14. All I Want to Know is Where I'm Going to Die so I'll Never Go There

15. Capital Returns** **

--------------------------------------------

** **Letters:1. Howard Marks Letters (Oaktree Capital)

2. Warren Buffett Letters (Berkshire Hathaway)

3. Mark Leonard Letters (Constellation Software)

4. Jeff Bezos Letters (Amazon)

Projects

Here are some projects // ideas I'm tinkering with:

Writing // thoughts

Investing:

The AthleticRobinhoodSnapchatJetInsightGoogle Hotel Finder--------------------------------------------

Ponderings:

Email as notificationsGovernments as platformsSalesThe Sung Park hiring test--------------------------------------------

Meditations:

First marathon learning"happiness" vs. "fulfillment"Obsession with conclusionsEnergyAsking others for adviceWhat was it all for?

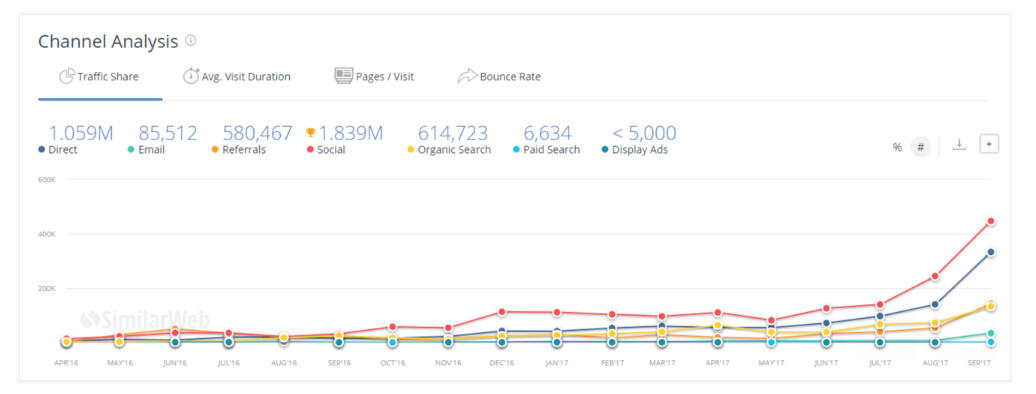

Google Hotel Finder

(written November 9th, 2017)Google rolled out the Map pricing feature in late May / early June of 2017...LinkHere's a theory - by placing the Google Hotel Map product right below the paid links, Google has changed consumer hotels bookings behavior.Pre-Hotel Map1. Google can sell at max 4 SEM slots for hotel searches - mostly to other meta-searches / OTAs.2. Once re-directed to the OTAs / meta-searches, consumers then click on 50+ hotels before booking - so Google is missing out on those 50 clicks // values provided from those 50 data points.3. Users attribute OTAs with the bulk of the value provided on hotels.4. The next time a consumer is about to book a hotel, they might bypass Google and go directly to the OTAs.Post-Hotel Map1. Now, Google Hotel Maps is capturing all 50+ of those clicks that used to occur on OTA / meta-search websites.2. Consumers now click on multiple links within Google Hotel Map for each hotel they are curious about.3. Users attribute Google with the bulk of the value provided on hotels, OTAs merely become the last pipe for finishing a transaction vs. learning // discovery // research.4. The next time a consumer is about to book a hotel, they will think of Google as the destination to do research vs. the OTAs.

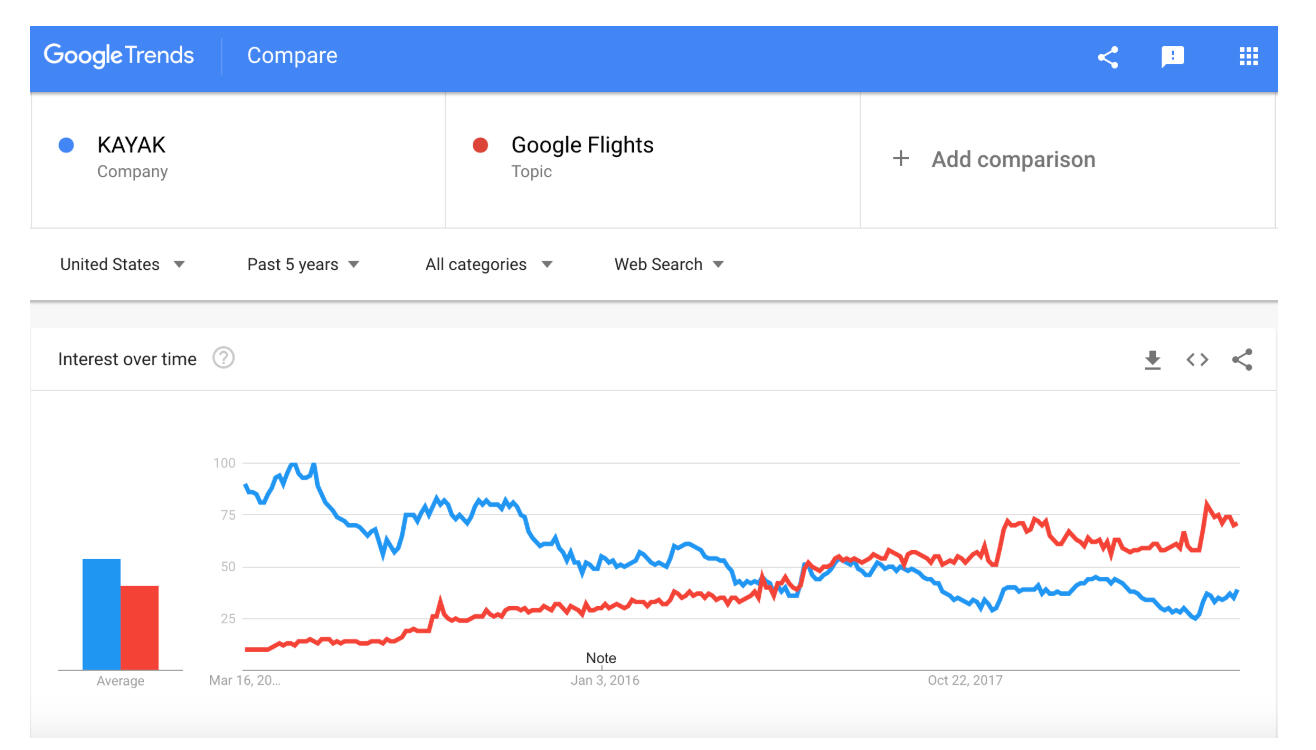

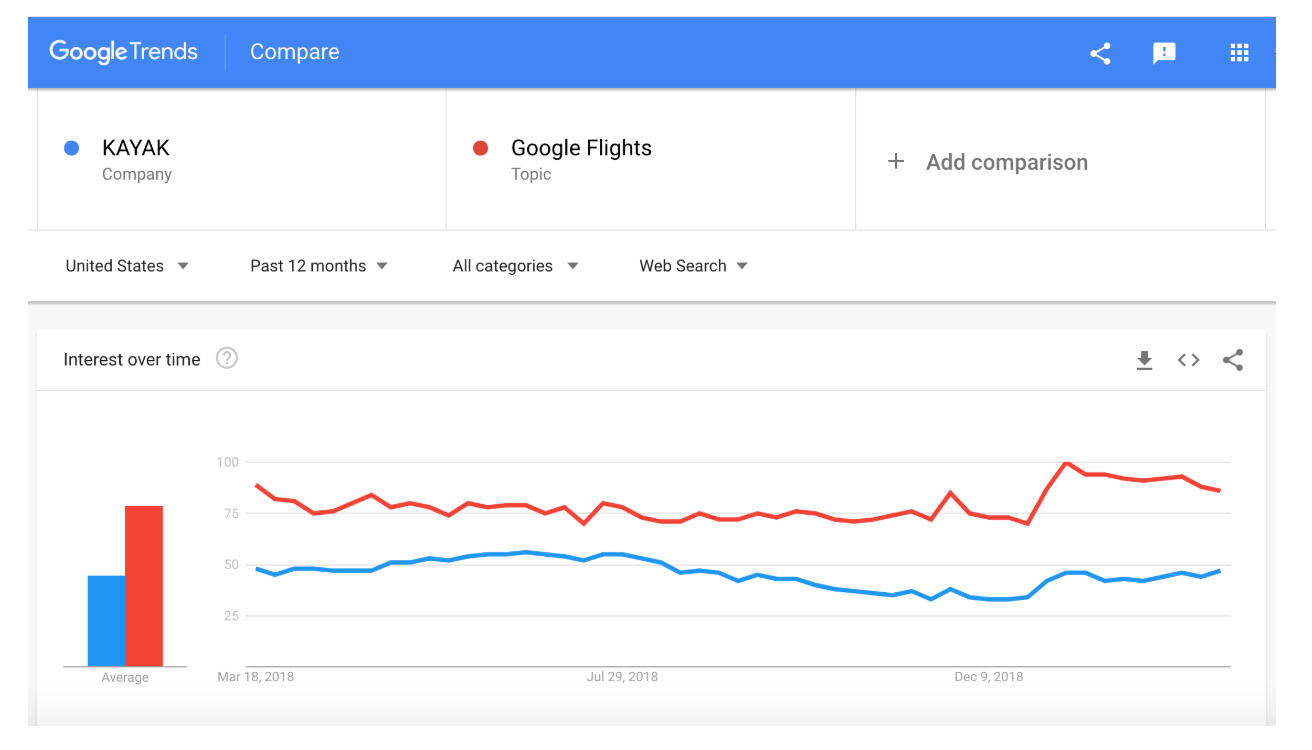

This is what happened to Kayak when Google Flights launched in most international markets in 2016...

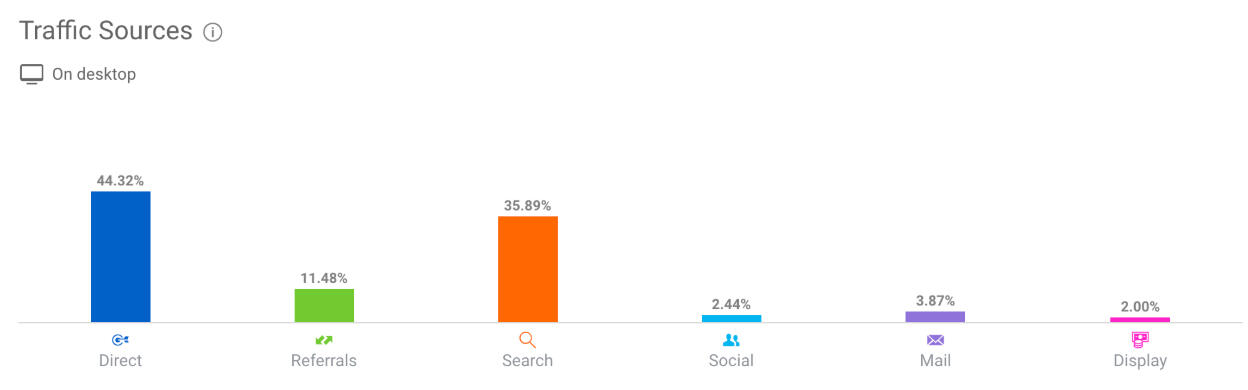

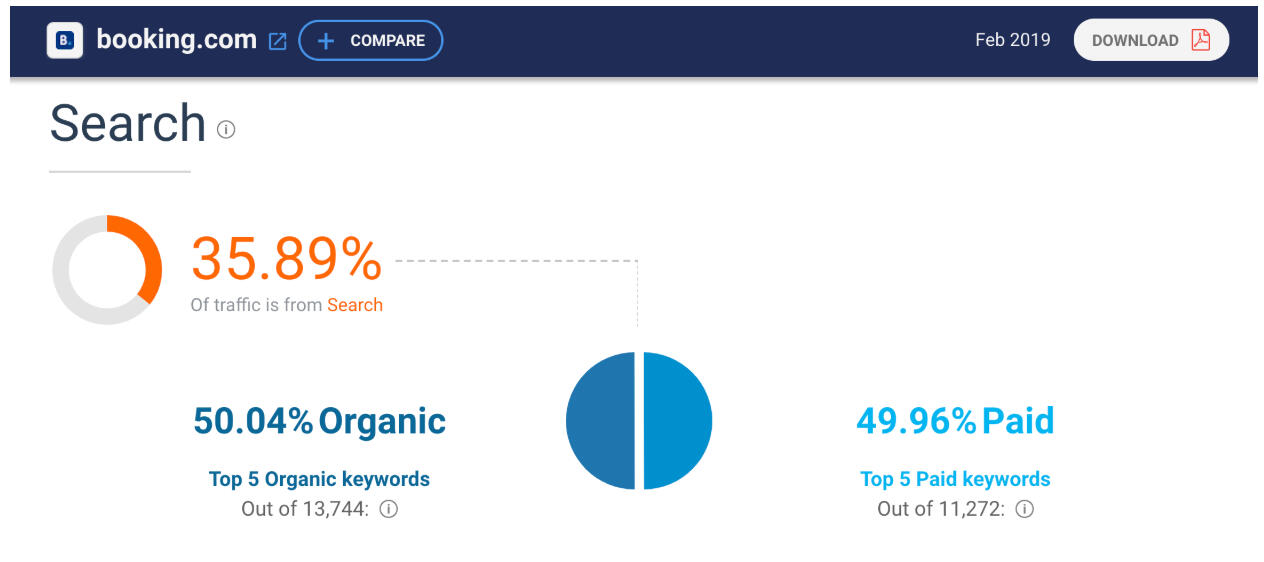

(March 12th, 2019)Why did Google make the move:1. I think this is a move to attack the SEO part of the OTA traffic... Google is probably sitting there going "why are we giving Booking.com 18% [50% organic of 36% of search] of their traffic for free?"Because BKNG / EXPE (and everyone else) is definitely trying to convert those Google leads to direct leads for the future.2. I think this might be a defensive move by Google.I wonder how fast Google core search queries are growing now? Maybe 0% to 5% yoy?I wonder if this is a move by Google because they are realizing that organic growth on their own platform is slowing or might even decline soon and they have a leaky bucket if they keep giving leads away and thus are in the stage of their business where they have to retain users at all cost?3. I think this is a perfect time for AMZN or another large direct users channel (Uber?) to start partnering with OTAs...

JetInsight

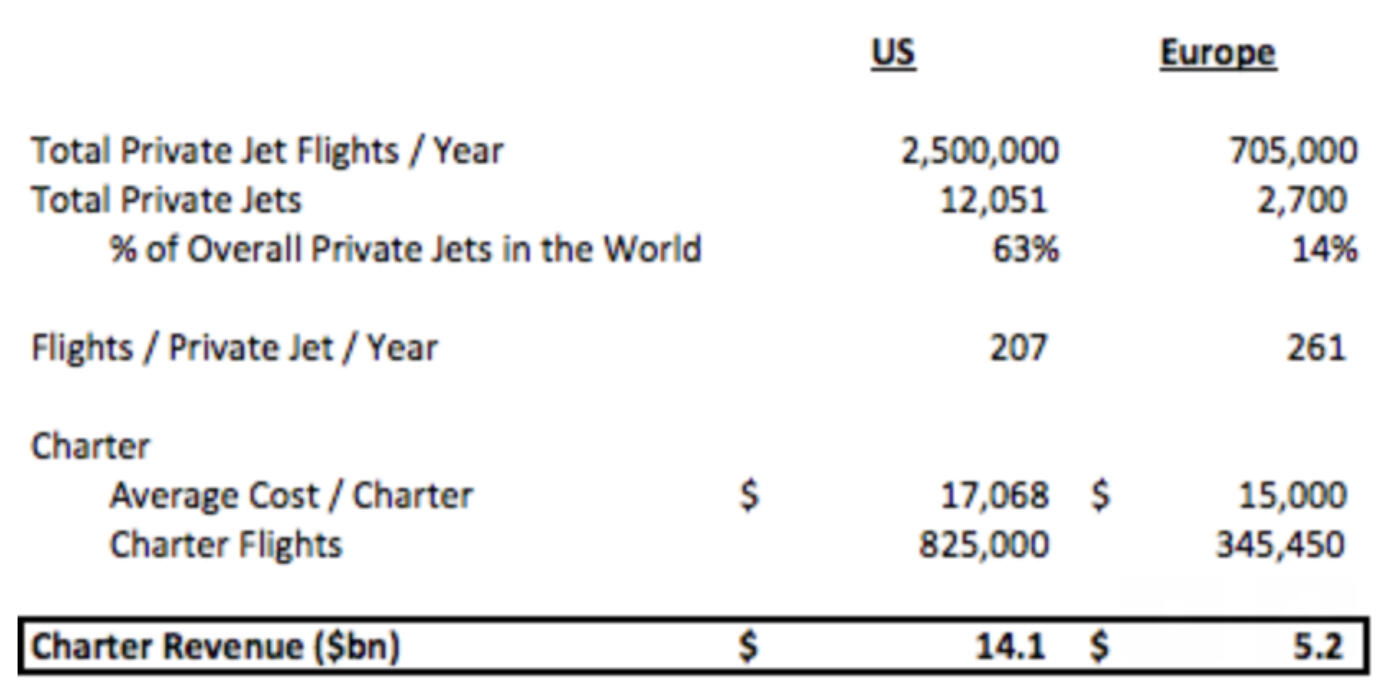

(written 2016)I believe JetInsight has the potential to get to 10%+ of the jet charter market ($2 bn / year in GBV) in the US & Europe and have take-rates of 15%+ ($300 mm / year in revenue) with at-scale margins of 40%+ ($120 mm in EBITDA).At 15x EBITDA, this is a $1.8 bn company.----------JetInsight has spent the last three years building the supply-side of the marketplace (via SaaS product for inventory management - like a PMS for hotels).JetInsight's strategy makes a lot more sense to me than others in the market:- JetSmarter (merchant model), Victor, Stellar - only have demand-side but no supply so no real time inventory (not a true marketplace, just traditional brokers)

- SurfAir, WheelsUp - asset heavy

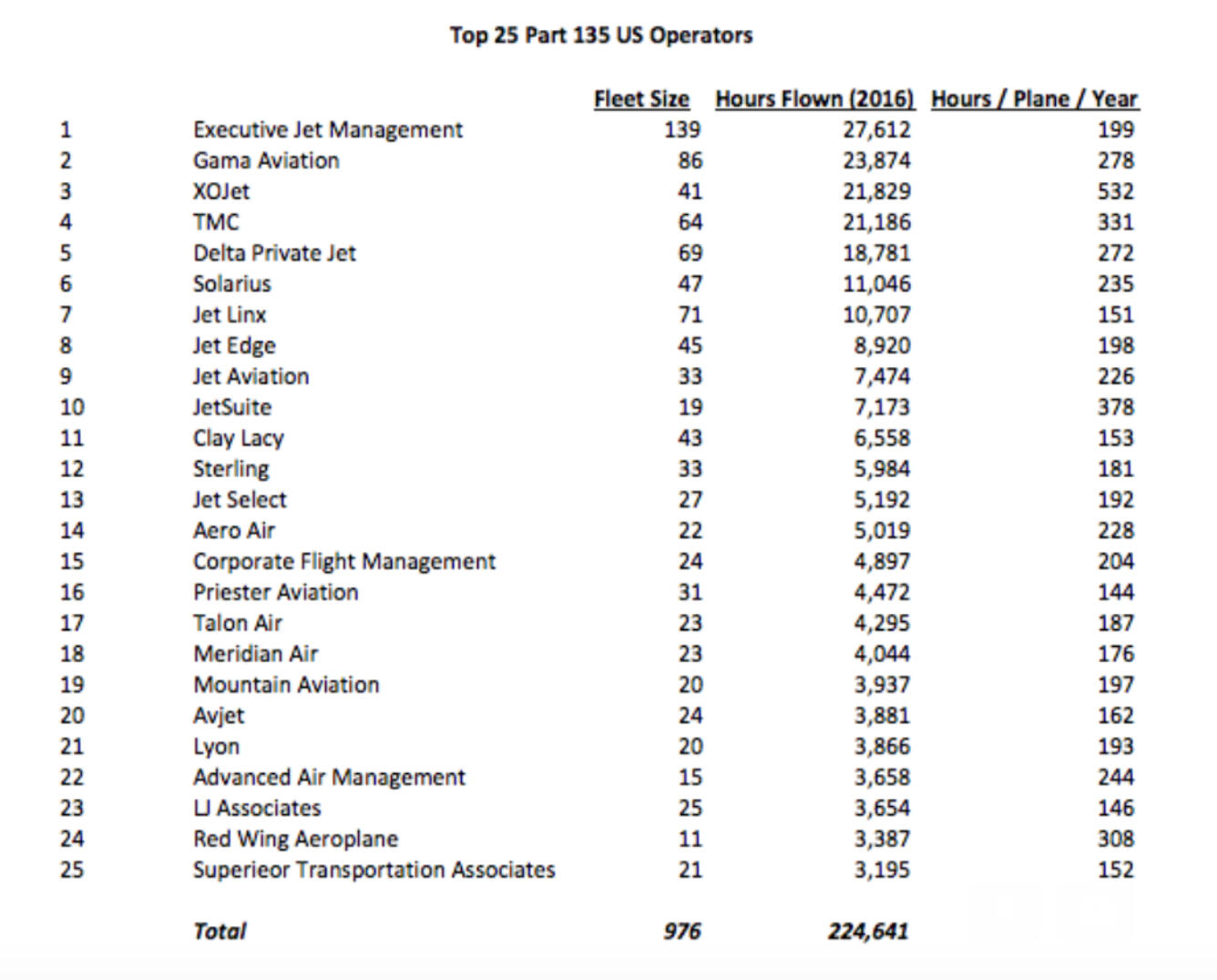

- Avinode - software product for operators and brokers but not real-time so can't be built into marketplaceI like JetInsight because they are world-class fishermen (team), fishing with the best tools (product), in a sea full of fish (market).----------Team:- Rockstar team

- Dave Benjamin - ex-BCG (projects dealt with aviations), GSB, Princeton EE

- Lou Montulli - founding engineer of Netscape

- Team of 13 - mixture of engineers and customer // operator success----------Market:TAM (private jet charters)- $20bn+ globallyLTV / CAC- At $17k / charter on average and assuming take-rate of 15%, JetInsight can earn $2,550 / flight.

- Charter brokers today take 20% to 30% so 15% in a heavily fragmented market is not only reachable but conservative.

- If we assume that the LTV is only one flight - I'd argue that it would be much higher because customers of JetInsight care a lot more about experience than cost thus will come back to JetInsight for all future charters - JetInsight can have $1k+ CAC and still be very profitable...

- The ability for JetInsight to withstand such high CAC potential costs provides it with many marketing channels (perhaps even TV // Super Bowl ads) and prevents future competitors because of the high starting costs for any incremental player.----------Fleet size today200+- Today, JetInsight sells software to operators. These operators operate 200+ jets combined.

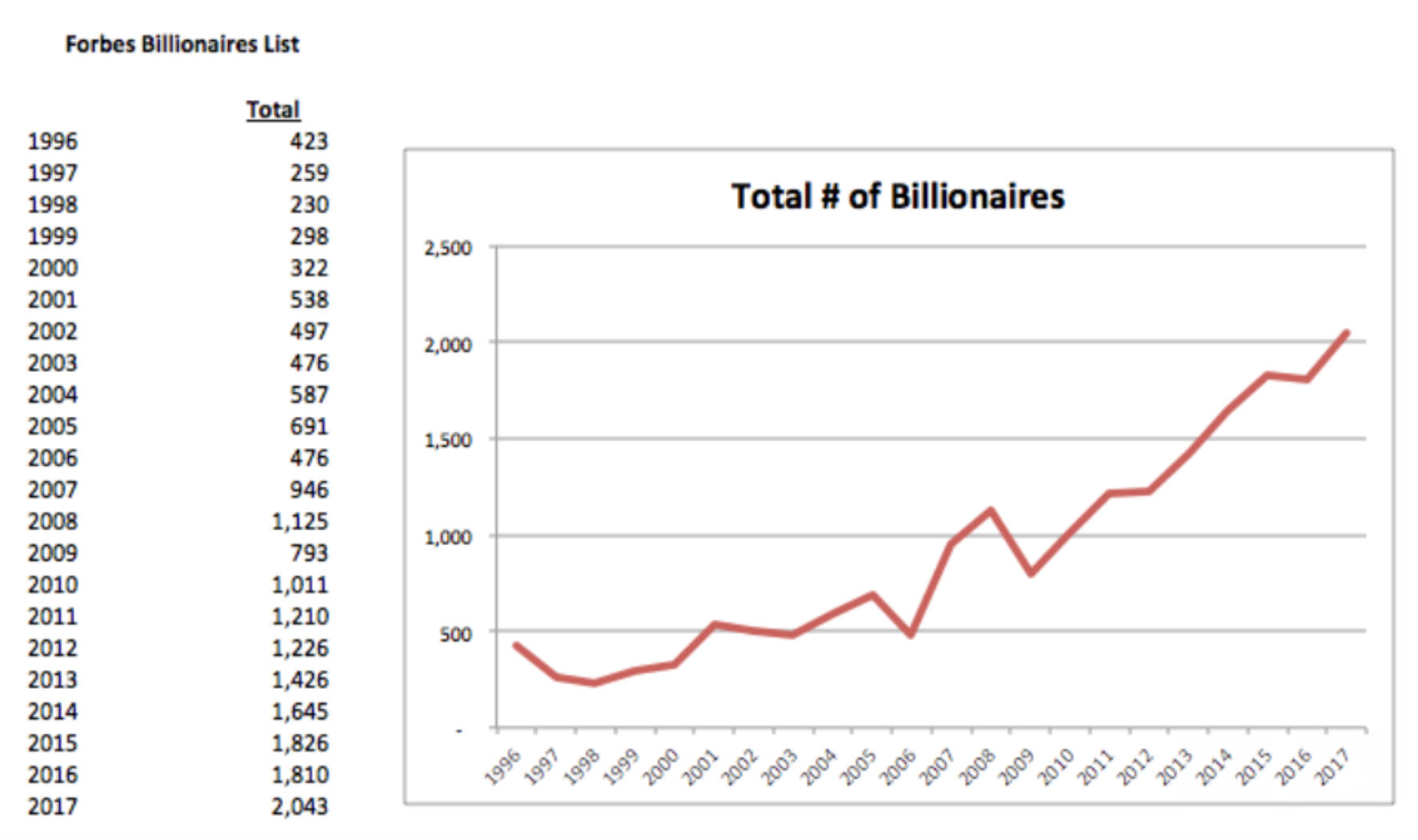

- This may not seem like a huge number but 200+ jets makes JetInsight's fleet larger than the current largest operator, Executive Jet.----------Macro factors- As society gets wealthier, the number of people who can afford to travel by private planes will only increase. The total number of billionaires in the world has doubled since 2010... wealth compounds.

- Today, about 33% of the US private flyers charter while the remaining 53% own their own jets individually or through a corporation. In Europe, 49% of private flyers charter while 33% own their own planes.

- I would expect more and more future private flyers in the US to charter (like Europe) as the barrier to booking charters decrease and the overall trust in a marketplace increases (barring major changes to tax code // tax write offs for owning a jet). This increases the TAM and growth potential for JetInsight.----------Product // moats:Software for operator crucial- Building a successful marketplace in private aviation is different from cars (Uber) and hotels (Airbnb // EXPE // BKNG) because of the unique logistical challenges of private charters.

- These unique challenges are why charter marketplaces need direct access to operators to see real-time inventory of planes and crew (something that is not in the market today).

- Supply (planes) has to be within reasonable distance to demand.

- Pilots have to be within reasonable distance to demand and have to follow FAA rest rules.

- Limited supply (unlike Uber; 10k planes vs. 250mm cars in US).

- High level of skill requirement (unlike Uber; most people can drive decently well but not properties not many people can fly planes).

- Extreme time sensitivity (unlike eBay).

- Unpredictable supply (unlike booking.com; hotel rooms stay in one place, planes constantly moving).Network effect- Because operators will want access to demand and having more operators creates a better experience for the demand-side, thus, it's a turn-wheel where supply side drives demand side which in turn drives supply side.High switching cost- Today, JetInsight's software is used whenever operators send quotes to brokers // perspective clients. JetInsight's software is mission critical to these operators and switching software will be extremely disruptive to operators.Supply-side lock-in- Imagine if back in the early 2000s, V12 created a marketplace for vacation rental property managers and other marketplaces can't link to V12 inventory... we probably would've never had HomeAway.

- Same analogy can be applied to PMS for hotels. Imagine if Fidelio or Hogatex had created a marketplace before EXPE and kept their inventory closed only to their marketplace...----------Questions:1. Have any operators churned? If yes, why and to whom?

2. What software // system are most operators currently using to manage fleet? How much do these other softwares cost?

3. Is pricing per seat or per operator? Both for legacy software as well as for JetInsight.

4. What’s the sales cycle like to sell the SaaS tool? What’s the ACV of each contract? Are contracts on an annual basis or longer?

5. Do operators talk to one another about JetInsight? Is there a word of mouth component to accelerate // organically drive sales?

6. Who’s the decision maker in the buying process?

7. What happens if an operator who’s on JetInsight decides to switch to another software tomorrow? How disruptive is it to their business? Essentially, what’s the lock-in on the software side of things?

8. How have you gotten most of you operator leads so far?

9. How are operators reacting to the potential marketplace side of the business?

10. What still needs to be built to make the marketplace side of the business work?

11. What types of inventories will the marketplace go after initially? Trans-con flights or local? Because this will require different types of planes // supply.

What was it all for?

(written May 2019)What was it all for?Sweating for the last hour. Being self conscious of how others are judging my body. Being uncomfortable. Getting caught up in a thought that isn’t real. Finding momentary pockets of bliss in my breathing.What was it all for? Doing yoga for the last hour? Just so I could get this perfect body? What is the perfect body anyhow?What is all for? Quitting my job two years ago. Starting companies. Traveling. I guess it’s all the same. It’s for nothing. It’s not for the perfect body because that will fade.It’s for the experience.The growth.Coming to terms with myself.Being.

The Sung Park hiring test

I started my first company, Squeeze (we made a contraption that automatically cooled beverages and were fortunate enough to get some capital from Carmen Scarpa who used to run Paul Tudor Jones’ private investment fund. Squeeze was a negative gross margin business which turns out aren’t sustainable but that’s another story…) when I was 16.While building Squeeze, I was fortunate enough to meet a ton of superb Boston-based entrepreneurs, one of whom was Ken Zolot at MIT. Ken then connected me to Sung Park because Sung understood consumer businesses. Sung is a serial entrepreneur based in Boston - while in his 20s, he sold a custom clothing company to Levi thus Levi Custom Jeans.I first met Sung when I was 16.During our first meeting, Sung told me that his son Spencer just got a Lego Robotics kit for Christmas (this was maybe January of 2008 or 2009).Spencer loved Legos but had never done programming so Sung was afraid that Spencer wouldn't be able to build the Lego.I jumped in and said I could help.Sung asked if I had ever built one. "Of course" was my response despite the fact that I hadn't touched a Lego piece in a decade."Great, meet me at my house in Newton next Saturday at noon and you can help Spencer build the Lego."A few days later, I Googled Lego Robotics tutorials for a few hours and then hopped on a train to Newton. Once I got to the Newtown train station, I called Sung."I'm here.""What?""You told me to be at your house on Saturday at noon...""Oh, you were serious…"Sung proceeded to pick me up from the train station and I built Legos with Spencer for three hours (I mostly just ate pizza and watched Spencer build cool robots). It turned out that Spencer had no problems building the Legos, nor did he have any problem programming the Lego robots - Lego had developed a very intuitive drag and drop command interface.At the end of the "tutorship", Sung paid me $100 despite me not wanting the money.That was also when I got Sung as a mentor.Years later, I asked Sung why he had met with me and decided to stay in touch with me.“Well, I meet with mostly everyone whom my friends think I should meet with. Most young people I’m introduced to never show up. Of the ones who do, I would give them a test of sorts - I would give them a signal of a problem I need help with and see if they’d intuitively jump in and give me ideas and want to be a part of the solution. Of the ones who don’t intuitively jump in - which is most young people - I’d layout the exact problem and ask them to help. Most never respond wanting to help. Of the ones who say ok to helping, almost no one ever shows up and actually help.“You were different though. You intuitively understood the problem. And you showed up - even though I didn’t expect you to. You’d passed the test - seeing a problem, finding a solution without me asking, and showing up and doing the work without expectations of instant reward.”I didn’t understand Sung’s story or reasoning until many years later.It turns out that:** **

--------------------------------------------

** **1. Most people want to be told what to do - they never seek to find problems and solve them.2. Most people want everything de-risked - they never want to take risk on an unknown problem that might never work out // face failure and potential self imposed embarrassment.3. Most people expect rewards upfront - not providing value first.4. Most people sit back expecting results - not showing up and doing the work.** **

--------------------------------------------

** **If you do one of the above, you are solid. If you do all four, you are golden.I think most members of an early stage enterprise need all four.If you find someone who posses all four characteristics, it is probably wise to hire them.

Asking others for advice

(written March 2019)"What decision should I make here"? or "what should I do"? or "should I invest in x"?For a long time, I sought the advice of others with regards to my life for the sake of deferring the "decision" on someone else and thus the outcome of the "conclusion" on someone else as well.The uncertainty of any path chosen scared me and the advice of a guru, although it did not make the path more certain, made the path more bearable because someone else whom supposedly has a "higher status" than me said it was ok.I now realize that that's the wrong approach - there is no guru or expert and the path chosen is the path I must walk whether determined by myself or a "expert" so I might as well walk my own path.Instead of "what decision should I make here"? it is better to ask "if you are in my position, what are the things you would think through"? listen to those items and come to a conclusion myself.In the end, it's about self responsibility and thinking for ourselves.

Sales

1. “Sales” is about gaining trust with the customer.2. Sales happens when the what you are offering aligns with the needs of what someone else is seeking.- Often time, there are multiple parties offering similar products and what the buyer ultimately chooses is much more emotional than “logical”.- This is why branding, storytelling, and ambassadors matter.3. Listen to the customer!4. Listen more than you talk. Figure out where exactly the customer’s needs are not being met (even on a human level). Figure out where they are having problems in their lives and see if you can help solve those problems.5. Don’t spend much time “pitching” or “going through the deck”. The fact that the customer is taking a meeting probably means they understand the high level of what you are offering the meeting is supposed to be gaining trust and making sure that the customer feels understood on a human level.6. Gain trust. Listen. Don’t judge.7. Go into the meeting with a “process” of how the pitch should go but be nimble enough to change on a dime and listen to other problems the customer wants to talk about that you currently can’t or won’t solve.- If you don’t do this, the customer doesn’t trust you and won’t buy from you.- The problems you can’t solve today are future products.8. The customer knows more than you.9. Add and give away more value than you take (whether it’s advice or pricing or just listening).

Energy

(written May 2019)People, places, activities all have their unique “energy”.People are both energy seekers as well as energy givers.Thus, it is wise to be conscious of your natural energy state, your current energy state, and the energy state you’d ideally want to be in.As an example, when I am maniac, being around others who are maniac by nature causes me to become more maniac which is counter to my natural state of calm. When I am maniac, I need the calmness energy to balance my maniac energy.When you are in a certain mood or state of mind, you need a certain type of energy to balance your current state. Being aware and seeking the right energy is the name of the game.

Governments as platforms

(written April 2018)Much like how the major tech platforms have more power than ever as the distribution layer, the same holds true for countries.Like tech platforms, only a handful (maybe only three - US, China, and Russia [because of nuclear]) control the vast majority of the wealth and power distribution and it’s getting more and more lopsided by the day.The moat of the Super Power countries is wider and deeper than that of any corporation.And unlike tech companies, there can never be anti-monopolistic or similar actions taken against these countries (especially China and the US).So betting on the companies in these countries (China, US) over a 50 year time horizon will likely yield good returns but betting on the countries these Super Powers will need on it’s side (especially as they compete against one another to win over those countries) will likely yield better returns.I've been thinking a lot about South East Asia from this perspective.I think the region will receive a large number of economic benefits from China, the US, India, and Russia in the coming decade because of SE Asia's location and the strategic implications in monitoring China and India.No matter which of the major powers gets more powerful in the coming decade, countries in SE Asia will benefit.It's not a bad way to live in the short-term because these countries get wealthier but a dangerous way to live in the long-term because they become pawns for whichever country they decide to back (platform risk).The downside of SE Asia is that it's simply too hot.I'm convinced that there's a negative correlation between days above 90 degrees and GDP :)

Obsession with conclusions

(written December 2018)So much of the Zen teaching is dealing with suffering. So much of suffering is having a pre-conceived conclusion of how the future will turn out and how to deal with that future if it’s not the same as the one in our minds.I remember my meditation session on October 30th, 2018 - what would you let go of and let into your life if you only had six months to live?It seems as though so much of what people would let go of revolves around conclusions and “winning” - letting go of getting that promotion, getting that girl, winning that deal.While the things people would let more into their lives revolves around love and things without “outcomes”.So it seems that we have an obsession with conclusions which I don’t think has anything to do with that conclusion but rather our ego. We want to win or have that girl to make ourselves feel worthy - to boost our egos. When we are dying (and we are all in the process of dying), we no longer care about that ego.Let go of the conclusion. Listen to music for sake of the music, not the conclusion. Just do.(I understand that this is an oxymoron from the “happiness” and “fulfillment” section where I talked about the need for a destination or journey which pre-supposes a conclusion; I am ok with oxymoron, life is full of them)

“happiness” vs. “fulfillment”

(written December 2018)I spent much of 2018 meditating (longest streak was 41 days straight) and hanging out in monasteries and temples across California, Japan, and Thailand (#blessed to have the time and money to do such discoveries at 25 / 26). For months, I stopped hustling - and stopped believing in hustling.At the beginning of this year, I would’ve been at peace spending 100% of my time living in a monastery with a giant moat, protected from external environments. There, I can meditate all day and live in "peace and happiness".Now, I am not sure - monks are protected from most of society’s stimulus but is that the point of living? Is the purpose of living to be “happy” but sheltered? For much of 2018, I was in a state of general “happiness” and “contentment” just breathing, however, I was not “fulfilled” because I didn’t have something to chase after.Also, nothing was chasing after me.Now, I want to be in the world, living with the external factors beyond my controI. I need stimulus, goals, the journey, destinations - the hustle.Or perhaps I didn’t fully understand the purpose and teachings of Zen.But still, isn’t the purpose of life to simply survive? I guess survival for some means removing oneself from all stimuli - and there is absolutely nothing wrong with that - but my meaning for survival (as of now) is being fulfilled which comes from creating and building and dealing with the punches of life.The "costs" of playing the "game".I guess I am much more ok with the process, the journey now - for that’s all THIS ever was / is - instead of the destination of “happiness” or “fulfillment” or x. The journey brings me fulfillment.This is a similar conclusion the Japanese figured out on how to keep fish fresh - put the fish in a tank with sharks so the fish have a challenge and a reason to thrive, the fish might not be "happy" but they felt more alive.

First marathon learning

(written May 2017)1. Ultimately, it’s a mind game2. Break things down into bite sized bits (1 mile at a time)3. Things are not constant (last 5 miles much harder than first 21)4. Stick through when things get tough5. First, most intense, last (just got to get through the most intense and you’ll be ok - AND, we can always get through the most intense)6. At the end, it’s you vs, you (no one gives a fuck about your time at the end of the day, except you)7. Dedicating things to people (family, blind man) makes your own challenges easier8. Having people to compete with makes the journey easier and makes you better9. Practice, practice, practice (the marathon is just the final act of all the practice sessions)10. Smile and enjoy the journey, because it will all end and you will ultimately miss some parts of the hustle

The Athletic

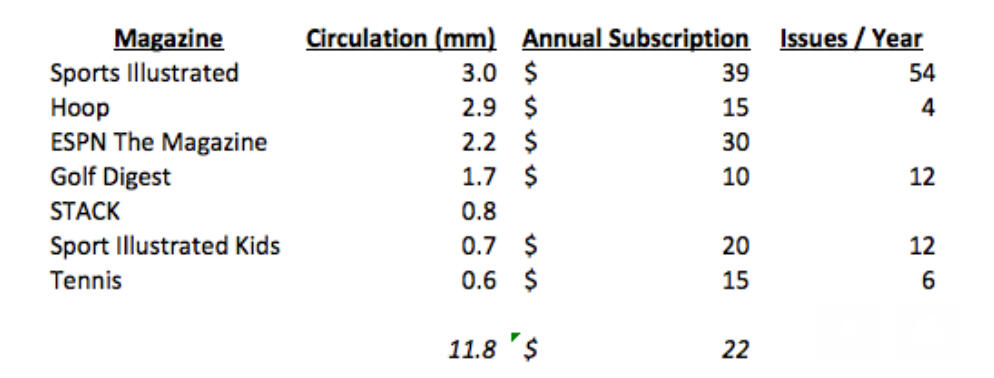

Why I think The Athletic is a great investment(written 10/22/2017)----------I believe the assumptions below to be conservative.The Athletic can exceed $100mm in revenue (2mm subscribers in the US and Canada, ARPU of $50), with $40mm in EBITDA (at-scale EBITDA margins of 40%).At 12x EBITDA (NYT multiple), this is a $480mm+ business.----------Company Overview:The Athletic publishes premium sports content in written format.The content is behind a paywall and can be accessed via a subscription:· $7.99 / montho 15% to 20% of subscribers· $47.99 / yearo 80% to 85% of subscriberso Full amount paid up front so cash flow can be used for operationsMost subscribers pay in order to access in-depth and unique stories for the professional & collegiate sports teams that they are fans of.The Athletic hires professional sports writers all of whom provide unique angles and have proprietary relationships with the players and coaches on the team that they are covering. These writers wrote for regional or national media platforms (i.e. ESPN, SI, CoachingSearch, newspapers) and are considered the best writers for the teams that they cover; thus, these writers have large social media followings on Twitter.The Athletic is currently at ~$5mm / year in revenue and has virtually spent $0 on customer acquisitions – this is mostly driven by writers tweeting content links to their loyal followers.Annual retention is ~90% for the worst cohort.The Athletic currently covers the local teams in the following cities:· The Bay Area (14.3k Twitter followers)· Chicago (23.7k)· Cleveland (10.3k)· Detroit (7.1k)· Minnesota (8.4k)· Philadelphia (10.8k)· Pittsburgh (6.9k)· St. Louis· Calgary (1.5k)· Edmonton (2.4k)· Montreal (3.8k)· Ottawa (1.3k)· Toronto (20.1k)· Vancouver (1.5k)· Winnipeg (1k)113.1k total Twitter followers, which may be a ballpark total subscribers number.----------Moats:· Network effecto By capturing the best writers (supply), loyal followers of the writers (demand) are willing to subscribe to The Athletic, which allows The Athletic to hire additional writers who can cover additional sports & regions, which brings on more subscribers…§ Example of demand following supply can be found in the comments section of Pierre Lebrun (hockey writer in Canada) joining The Athletic ---->https://theathletic.com/90956/2017/09/05/pierre-lebrun-why-im-joining-the-athletic/· Economies of scaleo Once The Athletic hires the necessary writers to cover a local sports network (i.e. Boston – Patriots, Red Sox, Bruins, Celtics, Revolution) and bring on enough subscribers to be break-even, the cost to service each additional subscriber is minimal and thus extremely profitable.· Intangible assetso By hiring the best sports writers, The Athletic can potentially monopolize supply, which dries up talent and potential platform competitors.§ Great writers want to follow Hall of Fame writers· It’s the OpenTable model – go into a city, acquire the top 10 restaurants. The next 10 best restaurants aspire to be like the top 10 so they organically sign-up, the next 100 restaurants want to be like the top 20 so they also sign-up and so on.----------Team:· Solid team + world-class writerso Team consists of <10 people at headquarters and 70 writers in the US + Canada§ Alex Mather (CEO)· Ex-Strava (VP of product design)§ Adam Hansmann (Co-Founder)· Ex-Strava (business operations & strategy)· Biggest worry in regards to team is the company selling too early----------Product:· Consumers find high quality & professional content necessaryo Today, most online sports publishing platforms are producing lower quality content with the explicit goal of creating clickable headlines in order maximize ad revenue.§ Most of these writers aren’t paid a guaranteed salary but rather a cut out of the views and ad sales.o Because The Athletic writers are paid a guaranteed salary and because of the subscription nature of the business, writers are incentivized to produce high-quality content because the only variable for these writers is their reputation.§ High-quality content that readers care about ensuring their reputation stays top-notch.o Data proves the necessity of The Athletic’s product:§ Scaling Cleveland (newer market) to 1k subscribers in 48 hours vs. seven months for 1k subscribers in Chicago (first market) shows pent-up demand for The Athletic content.o Analogy:§ The Athletic : Bleacher Report§ Netflix : YouTube----------Market:· Market size is the biggest question mark for The Athletic.· Season ticket holders = 3.3mmo One way to estimate TAM is the total number of season ticket holders in the major sports (die-hard fans) leagues in the US & Canada.§ ~3.3mm total· NFL = 2.2mm· MLB = 480k· NBA = 295k· NHL = 300k· Major sports magazines in the US = ~10mmo There are around 11.8mm total circulations for the top-7 sports-related magazines in the US. Accounting for individuals subscribing to multiple sports magazines, we can estimate unique subscribers to be ~10mm.· Total sports fans = ~100mmo According to Navigate Research, the major four sports leagues in the US garner the following fans:§ NFL = 83mm§ MLB = 59mm§ NBA = 41mm§ NHL = 21mmo The above adds up to ~200mm fans, accounting for individuals being fans of multiple sports, we can estimate that there are ~100mm unique sports fans in the US.· Margin of safetyo Based on the above methods to calculate TAM, The Athletic has ~3mm to ~100mm potential subscribers in the major four sports (MLB, NFL, NBA, NHL) alone. This is not accounting for tennis, golf, swimming, track & field, or college teams, which add tens of millions of more fans.§ By not accounting for anything beyond the major four sports, we have a margin of safety in our TAM estimate.· The Athletic subscribers = 2mmo We can reasonably assume that most of the 3.3mm season ticket holders discussed above are die-hard sports fans and can be up-sold on The Athletic subscription if it were bundled with the season tickets.§ Let’s haircut the 3.3mm season ticket holders by 40% for more margin of safety - we get to 2mm subscribers.· ARPU = $50o Let’s assume that The Athletic has no pricing power from the annual subscription price today (I think it does).o Let’s assume that no ancillary products can be bundled on top of the current written content such as video, podcasts, merchandise, ticket sales, etc. (I think there are many ancillary add-on opportunities).o Let’s also assume that The Athletic stays only in one vertical – sports – as opposed to applying a similar model in verticals such as politics, fashion, wellness, cooking, travel, etc. (I think there are other verticals The Athletic, with a name change, can dominate).

Robinhood

Why I think Robinhood was a great deal(written 5/16/2018)----------When CAC = $0 and LTV = massiveRobinhood, the $0 commission trading platform, recently raised $363mm @ $5.6bn.Many people called the deal crazy as the company’s revenues isn’t anywhere close to justifying a $5.6bn valuation — however, I think Robinhood is a brilliant financial products aggregator (partial un-bundling of highly valuable Google search terms) in the making and will have plenty of revenue growth from products outside of trading for decades to come.----------My basic thesis is that:1) Robinhood’s CAC is essentially $0 and they’ve built their base of users to 4mm+2) because the users are so young (30), can upsell them on future financial products such as banking, insurance, mortgages, and loans (large LTV, Robinhood becomes an aggregator for financial products)3) doesn’t abuse pricing (lowest cost provider) so will have plenty of pricing power for decades to come----------Downside protected:- raised $539mm to date, a brokerage such as Interactive Brokers would buy Robinhood’s 4mm+ users for more than the amount raised to date so preferred shareholders are safe----------Upside:- started with high daily check product — stock trading — so top of the mind for users when it comes to personal finance- lowest cost provider; hard to compete against them if you are a startup, harder if you are a publicly traded incumbent player with an existing corporate structure- long runway with current users (average users is currently ~30 years old) who will continue to be Robinhood users for decades to come- will upsell other financial products such as insurance, mortgages, loans with $0 CAC because the users are already on Robinhood- Robinhood is one of the few platforms that knows your bank account information — hard to re-build that trust as well as inconvenience in inputting banking information- Robinhood has risk data of users based on how often they trade and how well they trade; that data moat will only increase- flywheel of future products will increase users and user reliance on Robinhood which will afford Robinhood the ability to build more products - starting with crypto trading which is essentially is a cheap customer acquisitions play

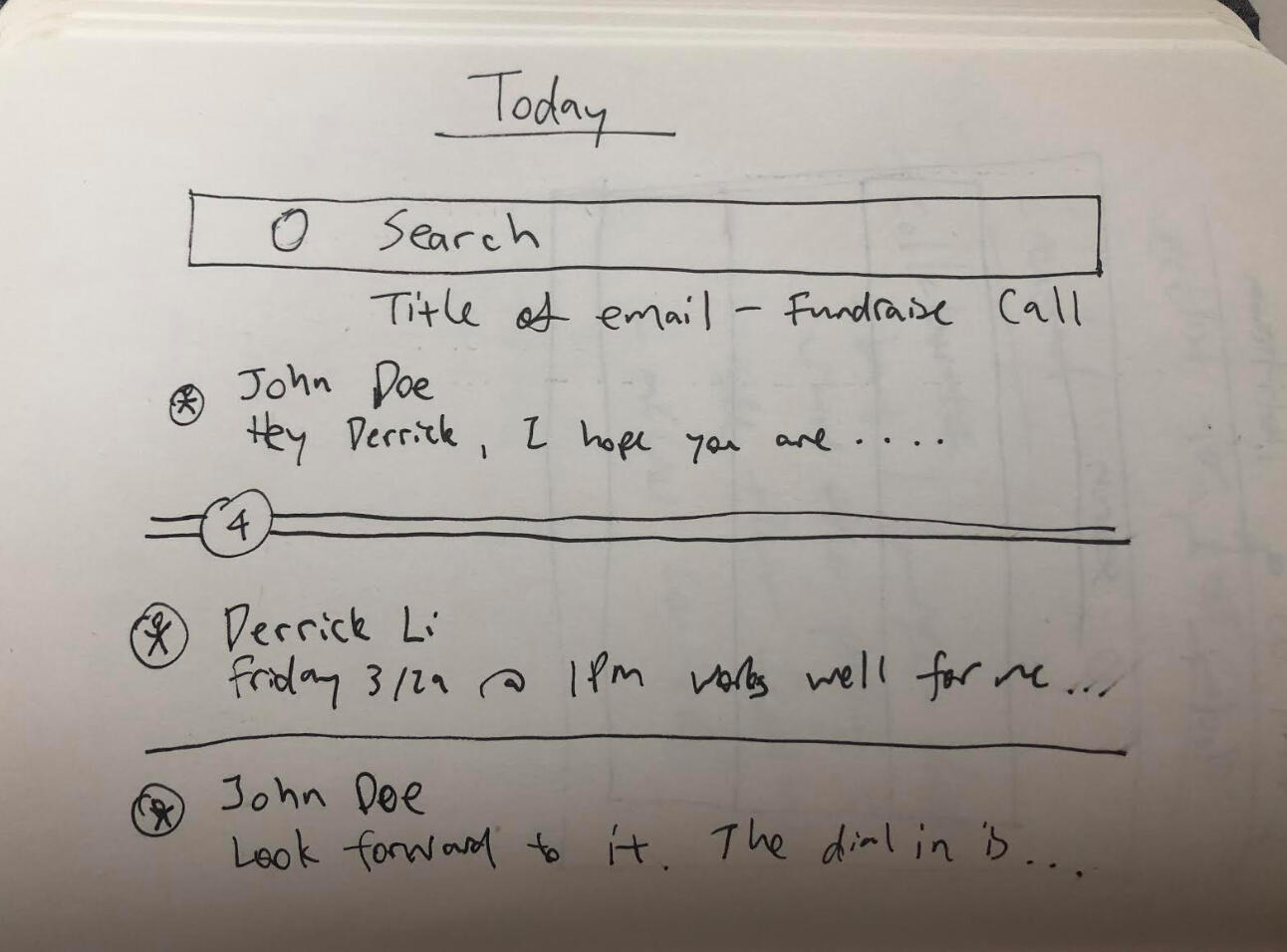

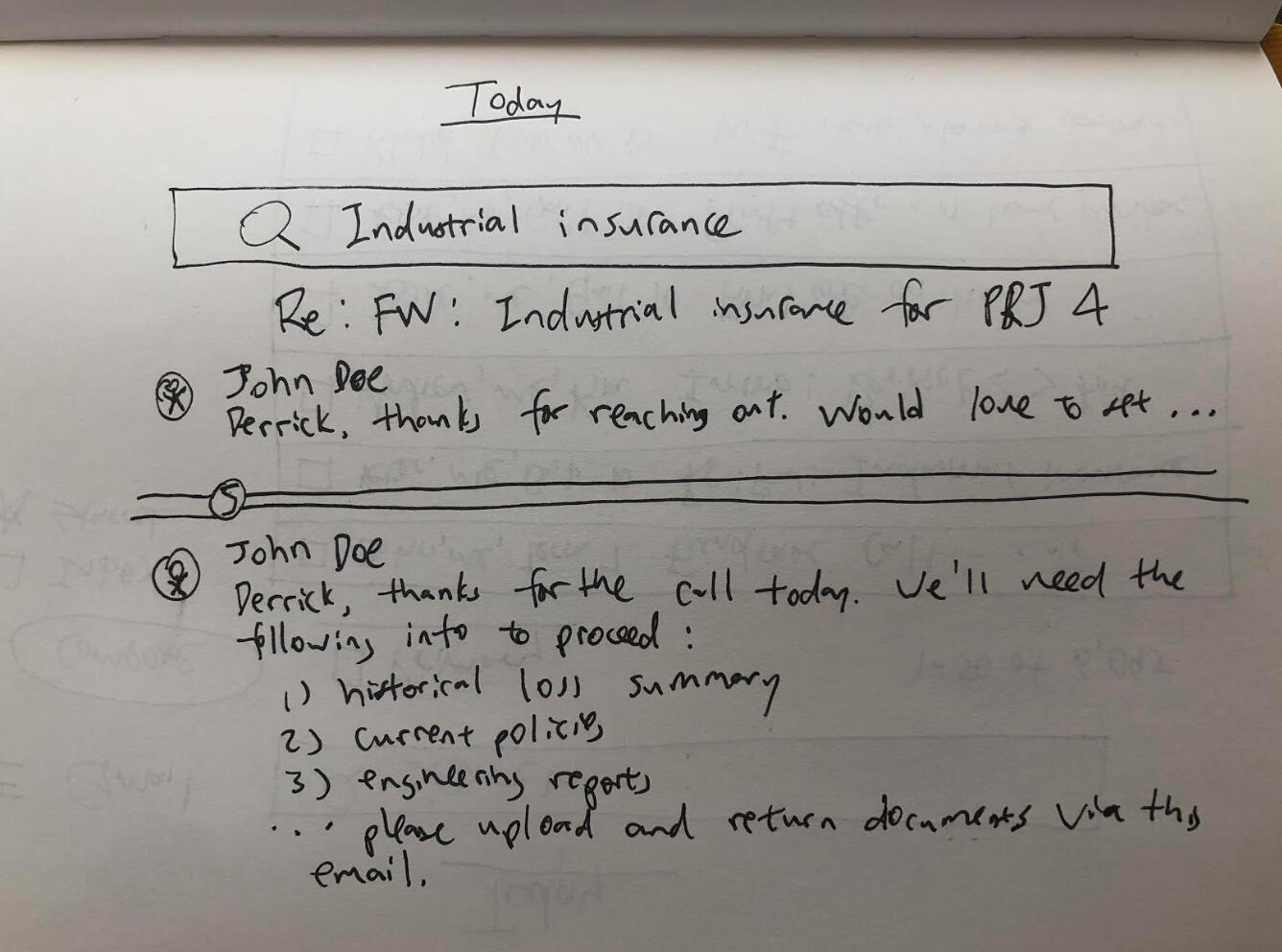

Email as notifications

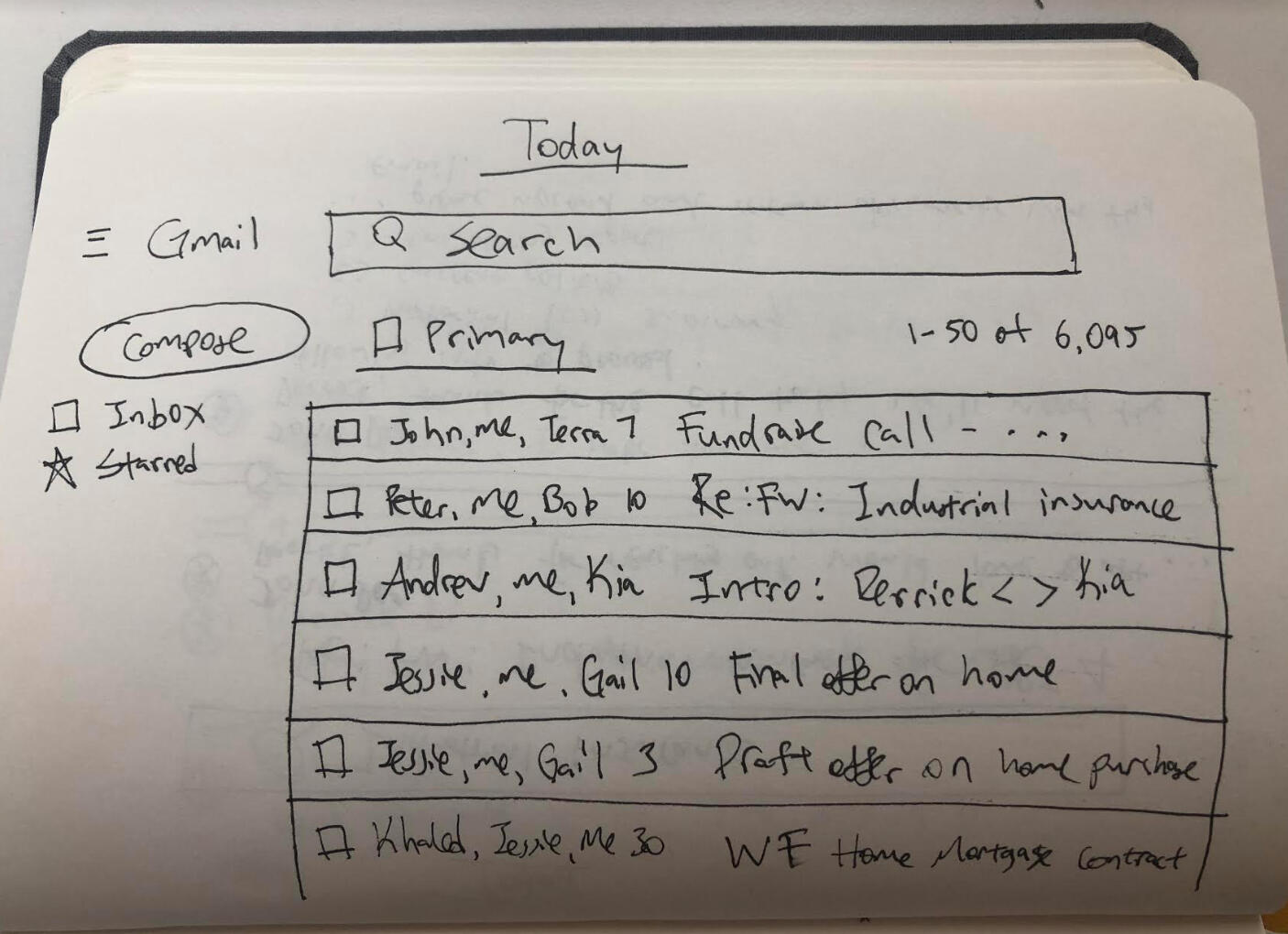

(written March 2019)The operating system for most organizations is email. The operating system for the most efficient organizations are custom built.----------The un-bundling of email:Email is the ultimate horizontal work solution - storage of institutional knowledge, CRM (customer relationship management), internal collaborations and communications, external collaborations and communications.Yet, email is not the best at any one of these functions. Thus, a whole host of tools have emerged verticalizing specific email capabilities.- Box, Dropbox, Confluence, Wikis = storage of institutional knowledge

- Salesforce, Freshdesk = CRM

- Slack, Asana, Trello = internal collaborations and communicationsa. most often un-structured because contents are usually around problems to solve or general internal banter

- Intercom, custom by company, (still email) = external collaborations and communicationsa. most often structured or else the company cannot scale----------The problems with email in regards to external collaborations and communications are:1. Unclear processes- what is needed to go from start to finisha. If I am buying car insurance, what are the next steps, documents I needs, etc. to go form engaging a broker via email to having a car insurance?2. Need for other party(ies) to engage / send next steps / documents needed to continue processa. If I send my insurance broker my drivers license and bill, I’ll now need to wait on the broker to approve my documents and send me the next steps3. Wasted time / energya. A process (such as buying car insurance) that should take 30 minutes from start to finish now is spanned out across 10 days because of un-needed back and forth communications----------I strongly believe that external collaborations and communications will have dedicated tools that:1. Lay out the steps needed for the project at handa. If I am purchasing car insurance, here are the 10 steps to go from engagement to getting a car insurance2. Have documents embedded within the steps so no need to wait on humansa. Once I send my drivers license (step 4) via the dedicated tool, I automatically get a contract to review which is triggered by the completion of step 4----------Email as notifications:Once dedicated tools take over the “workflow” of external collaborations and communications, email will then be no longer a back-and-forth tool for communications and sending information / documents. Instead, email becomes a notifications channel - “Your car insurance is now approved, click here to go to X site”.I think Slack will be notifications for internal teams and email will be notifications for customers / external.Here’s how external email communications work today:

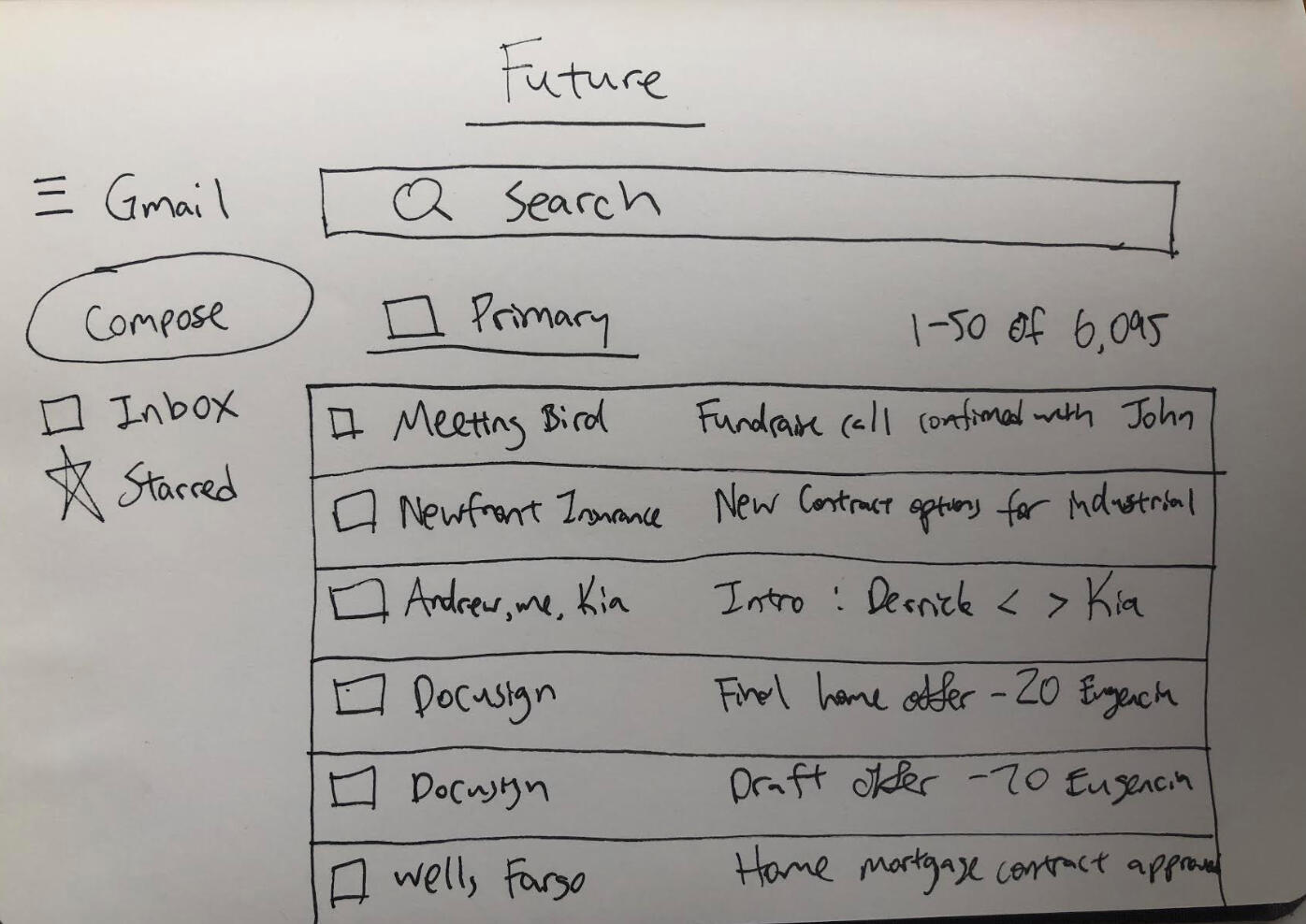

Here’s how I think email will look in the future: